We serve multiple industries. Please select from the list below to learn more.

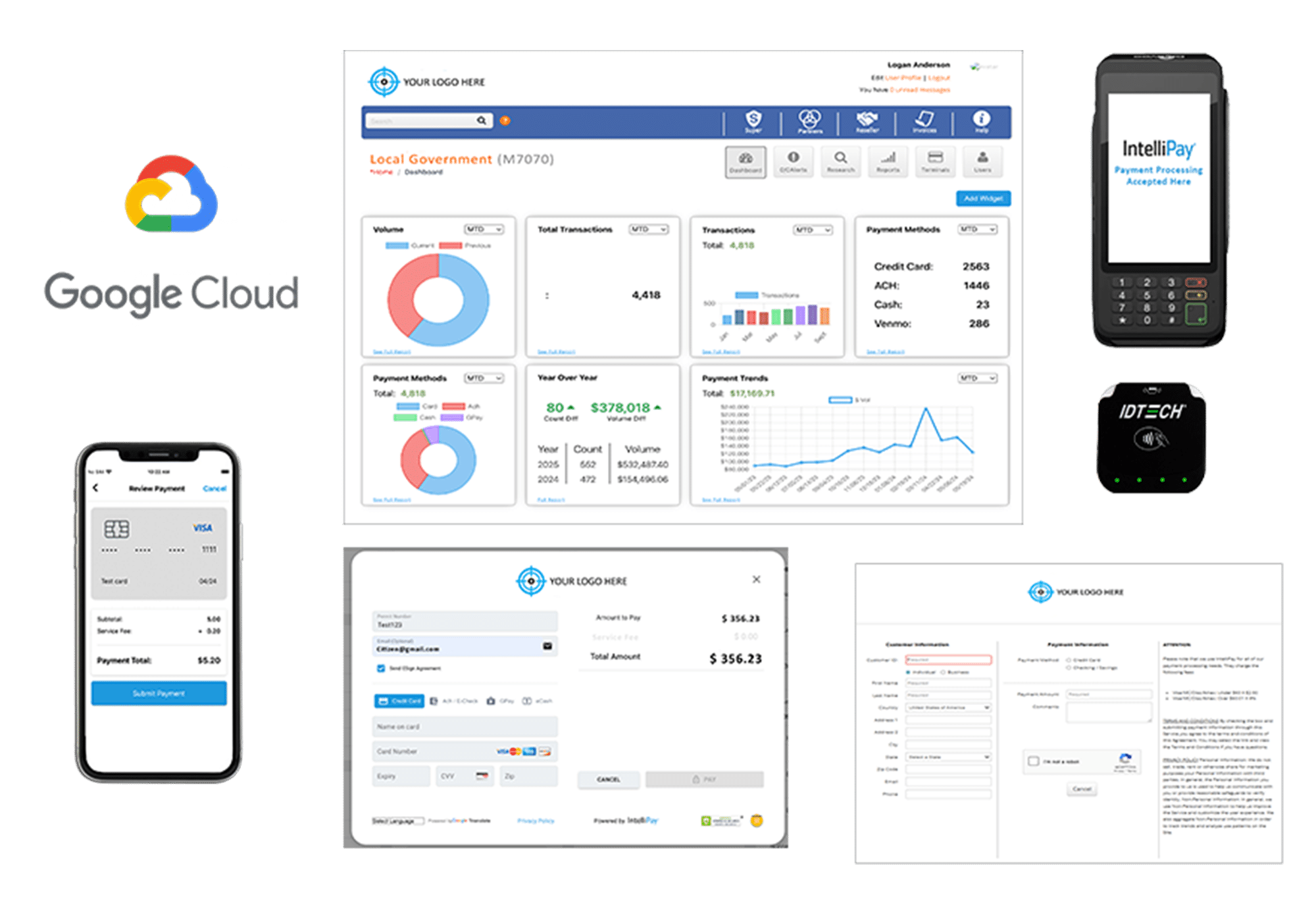

Payment Processing & No‑Cost Payment Gateway Solutions

Cut costs and simplify card and ACH payments- Shift processing fees to customer options

Manage all payments – one log-in

Welcome to IntelliPay

Customizable In-Person and Online Payment Solutions for Every Industry

Simplify Payments, Save Time

Most growing businesses spend hours each week logging into systems, matching deposits, and balancing records.

IntelliPay connects to your existing systems, delivers real‑time payment data, simplifies every step, and can cut reconciliation time by up to 50%.

Improve Marginson Card Payments

A small business processing about $1.2 million in card sales each year can spend roughly $19,000–$24,000 annually on payment processing once all rates, assessments, and fees are included.

Those costs cut directly into profit and make it harder to grow, hire, or invest back into the business.

How IntelliPay Helps Reduce Processing Costs

IntelliPay’s transparent interchange‑plus pricing, no junk fees, and fee‑based options are designed to lower what you pay to accept cards and improve your operating margins.

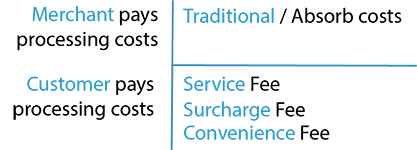

By shifting some or all processing costs to customers who choose to pay with credit cards, your effective rate drops while you keep card acceptance and customer choice.

Fee‑Based and Dual Pricing Options

Choose from compliant fee‑based programs—dual pricing, surcharge, service fee, and convenience fee models—that can offset or even eliminate your net credit card processing costs on eligible transactions.

Each option follows current card brand rules and state regulations, helping you reduce fees without increasing compliance risk.

Why IntelliPay?

All-in-One Suite

Easily manage in‑person, online, mobile, and recurring payments for every location from a single dashboard, instead of juggling multiple systems and vendors.

Consolidate reporting, reconciliation, compliance, and user access in one place so your team spends less time on manual tasks and more time serving customers or constituent

Complete Control

Set user roles and permissions, automate routine tasks, and monitor every transaction across all sites for clear oversight and audit‑ready records.

Streamlined reconciliations and on‑demand, drill‑down reports give your team secure, easy access to the data it needs to answer questions, resolve disputes, and manage risk.

Reduce Costs

Want to lower what you pay in card fees? Choose from dual pricing, surcharging, service fee, and convenience fee models that can shift some or all processing costs to customers on eligible transactions while aligning with card brand rules.

These flexible options can reduce or even eliminate net card processing costs on qualified payments, helping improve margins without sacrificing customer payment choic

Secure. Fast. Flexible.

Accept credit and debit cards, digital wallets, and ACH across in‑person, online, and mobile channels on a PCI DSS Level 1 network designed for high‑volume, mission‑critical payments.

End‑to‑end tokenization, encryption, and built‑in fraud prevention help protect sensitive data and keep checkout fast, secure, and convenient for you and your customers

Want to learn all that IntelliPay can do for you?

Ready to get started?

Payment Upgrade

We quickly add online payment solutions to existing pages or replace what you already have with a single payment and gateway solution. Schedule a demo to learn more.

Need a custom solution?

Integrate via API or white-label your experience. Then, leverage our experience to help you position integrated payments with your customers.